MLB 401(k) Plan Explained (2023 Update) | Josh McAlister

Talk to the author about your MLB 401(k) questions:

In this article, we aim to provide quick and easy guidance on how to handle your MLB 401(k) plan and point you in the right direction on the following:

What is a 401(k) plan? When can you contribute $?

Types of $ Contributions

What to do when you retire

What is a 401(k) plan?

A 401(k) is a retirement account designed for retirement savings. The IRS and U.S. government desired to incentivize taxpayers to save. Thus, they wrote into law the 401(k) tax code to set up the 401(k) defined contribution plan.

There are two general types of 401(k) plans: Traditional 401(k) or Roth 401(k). The difference between the two plans is the timing of when you will pay taxes on the money held within a 401(k) account. For example, the MLB 401(k) plan is a Traditional 401(k) plan.

You may be asking, "if I get all these tax benefits, what is the catch?" To keep taxpayers invested within the 401(k) plan, the IRS enforces a penalty on funds taken out of a 401(k) account before 59 ½. This penalty is steep – 10% of total funds if withdrawn before 59 ½.

Who Is Eligible:

Players could participate in the 401(k) plan if they were a member of the Investment Plan on March 31, 2012. After this date, a player with one day of credited service with a Major League club during a championship season is eligible to participate in the Investment Plan.

You are a plan member if you are actively accumulating accredited service time.

Where Is The 401(k) Held?

Vanguard is the custodian of the MLB 401(k) plan. You can set up online access through this website.

The Enrollment Form:

Annually, players must fill out an enrollment form to set up their annual contributions. The annual contribution is a significant financial decision you should discuss with your financial team.

You can either make a Pre-Tax Contribution and/or a Post-Tax Contribution. There is a third election to make a pre-tax 'catch-up' contribution, but this is only available if you are 50 years or older.

However, keep in mind that if you select both the max pre-tax and max post-tax contributions, you may overfund your 401(k). For example, this could happen if any club contributes to the plan in the same calendar year.

Contributions:

There are three types of cash contributions for your MLB Vanguard 401(k) plan:

1. Pre-Tax Contributions

2. MLB Contributions

3. Post-Tax Contributions

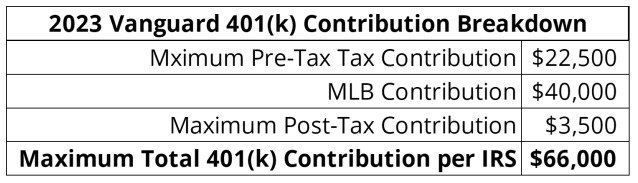

Below is a breakdown of a player who wants to take full advantage of the maximum allowed pre-tax and post-tax contributions in the calendar year 2023:

The maximum amount a club can contribute on your behalf is limited to the maximum amount allowed by federal law ($66,000 in 2023). This $66,000 includes any pre-tax, post-tax, and MLB contributions. However, the parties in the Basic Agreement determine the club's actual amount to be contributed.

Pre-Tax Contributions:

The maximum pre-tax contribution players can make for 2023 is $22,500. Technically referred to as an “employee contribution,” this contribution delays the income tax paid upon your 401(k) plan withdrawal. This contribution also lowers your annual taxable income that year. See below for current year tax savings, assuming a 40% marginal tax rate:

Note that any pre-tax contributions plus investment growth within the account from these contributions are taxed upon withdrawal during retirement.

Post-Tax Contributions:

Unlike the pre-tax contributions explained above, there is no tax deduction if you make a post-tax contribution. However, you never pay taxes on any post-tax contributions again. In other words, you do not pay taxes on these post-tax contributions when you receive a distribution from your 401(k).

However, the investment earnings on your post-tax contributions are subject to the same tax treatment as your pre-tax contributions and investment earnings on those contributions. In other words, the growth of your investment earnings is not taxed until it is taken out of your 401(k) account.

MLB Contributions:

The MLB grants its contributions to your account based on service time. These contributions are treated as pre-tax contributions and are taxable at withdrawal from the account. Note that the club contributions are always treated as pre-tax contributions.

The contribution within this plan is not a match. Instead, it is up to the club's discretion regarding the amount that it contributes. These contributions happen automatically, vary by year, and do not require any documentation submitted by the player.

In 2023, club contributions will be $10,000 for each service quarter. You receive these contributions into your account for every 43 days of service time you play. For a full year of service, a player will receive $40,000.

Vesting:

You are always 100% vested for all types of contributions made to your account.

MLB 401(k) Plan Rollovers:

Once a player officially announces his retirement, he can "rollover" his current 401(k) plan into an IRA, Roth IRA, or another employer-sponsored 401(k). Some considerations for moving your 401(k) balance to another retirement plan would be the tax characterization, availability of investment options, and costs.

It is important to note that a qualified "rollover" of pre-tax contributions creates no taxable event for the client if done appropriately. You should consult your advisor for appropriate rollover procedures.

Benefits for the Player:

Integration of this account within your comprehensive financial plan allows you to practice tax-efficient investment strategies effectively.

You receive tax delayed investment growth within the account.

Ability to assist in the appropriate rollover of pre-tax and post-tax contributions into an IRA or Roth IRA once retired.

Conclusion:

Being called up to the big leagues is an achievement like no other. Unfortunately, players submit retirement contributions based on emotion, their teammates' actions, or a different information source who may not understand the player's complete picture. Instead, you should partner with an advisor who knows what to recommend as a Major League Baseball Player for your specific situation.