The Importance of 43 Days of MLB Service Time

Want to talk to the author about your MLB service time questions?

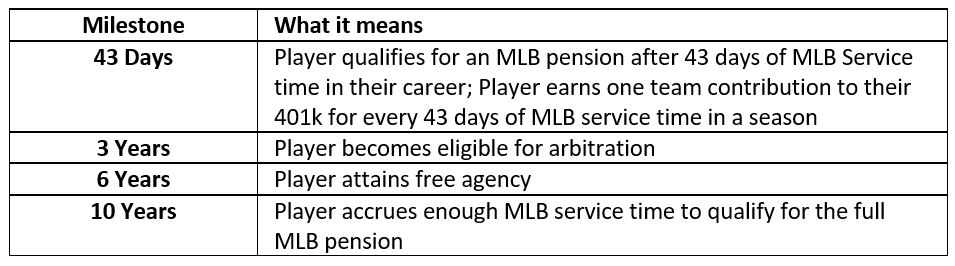

Most Major League Baseball players have heard about the importance of service time milestones for reaching arbitration, free agency, and earning a full pension.

One of the earliest milestones players are focused on is achieving something known as Super Two status. This is when a player earns an extra year of arbitration eligibility before reaching 3 years of MLB service. The following is how they would qualify for this status:

Have between 2-3 years of service time,

Earned at least 86 days of service time in the preceding year, and

In the top 22% of service time for all players between 2-3 years of service time.

While these milestones only apply to a small percentage of players, achieving 43 days of service time is the most important milestone that every player should be aware of.

Important MLB Service Time Milestones

Understanding How MLB Service Time is Calculated

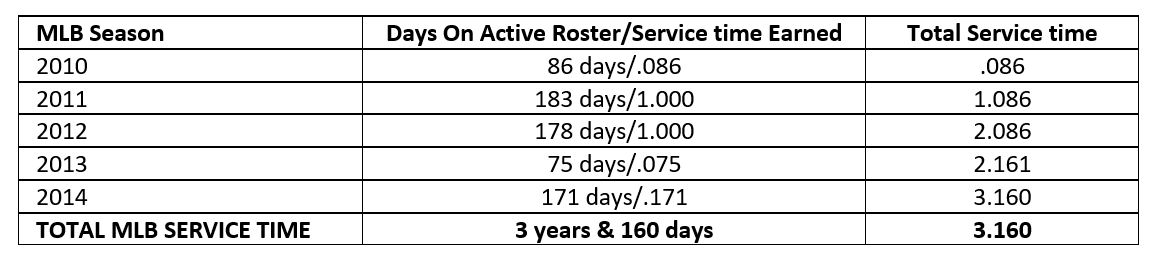

A full year of service time is defined by the MLB as 172 days. A player receives one day of service for each day on the active roster or on the Major League injured list. In 2021, the regular season consisted of 162 games played over 186 calendar days.

Currently, the service time calculation is capped at 172 days on the active roster per season. Therefore, when a player spends less than 172 days on the active roster or injured list, they receive a partial year of service time added to their overall calculation.

The table below gives a hypothetical example of a player's service time calculation over a five-season span:

*A full year of service time is notated as 1.000 in the "Total Service Time" calculation, while a partial year is noted by the number of days during the year that the player was credited.

Why Are 43 Days Of Mlb Service Time So Important?

Forty-three days of service time is important because it impacts a player's MLB 401k ("Vanguard Account") and eligibility to receive their pension in retirement. Having access to and contributing to these retirement plans greatly impacts their future financial picture.

While 43 days is important for access to the MLB 401k and pension plans, the effects and calculations are slightly different for each, as noted below:

MLB Pension Plan

While most players focus on 10 years of MLB service time, a basic understanding of the pension plan is not discussed in locker rooms. Unfortunately, this understanding is often missed by many financial advisors. Nevertheless, this plan can often have positive effects even if players do not reach full pension status.

According to the MLB Players Association, less than 10% of MLB players have reached 10 years of service time, with only 32 reaching that milestone during the 2021 season.

How do I earn an MLB Pension?

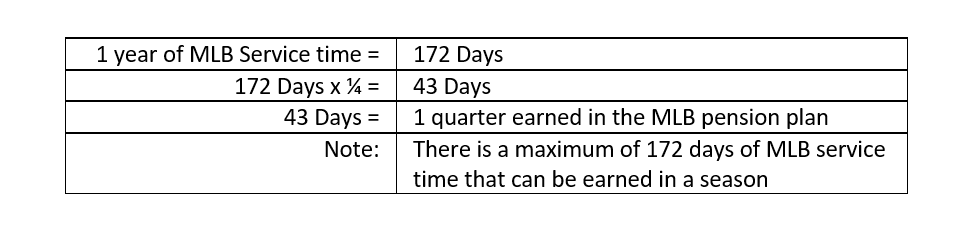

While a full pension is obtained after accruing 10 years of service time, this pension is broken down into smaller pieces earned throughout a player's entire career. The full pension consists of 40 quarters that each have a pension value attached to them. Therefore, a player can earn a partial pension by earning less than 40 quarters in their career.

Partial pensions are earned for each quarter (43 Days) of service time, which in 2021 was valued at $5,750 per quarter. Knowing that each quarter is so valuable to their retirement, most players naturally want to know how the quarters are calculated.

For this calculation, all of the days of service time earned over a player's career are added together. The result is the final number of quarters earned at retirement. This means that every day of service time earned is significant and can impact the amount of money available through the pension system.

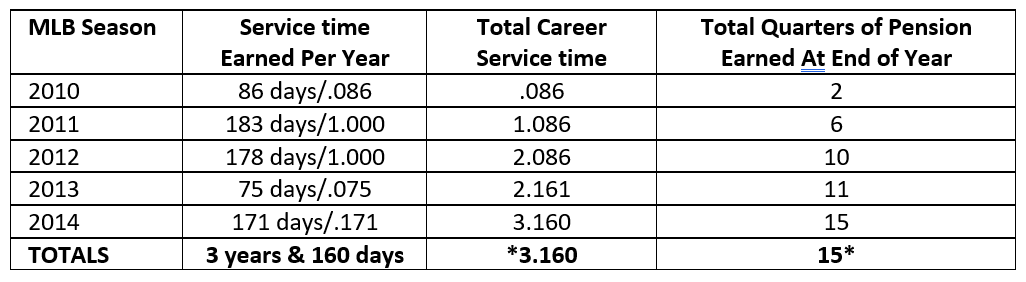

Looking at our hypothetical service time calculation from earlier will help give us an understanding of how quarters are accumulated:

*This player needed 12 more days of MLB Service time to reach 4.000 years and 16 Quarters earned

In 2010, the player earned 86 days of service time. Before reading this article, 86 days might not seem important, but it is a massive accomplishment for this player. Those 86 days would have qualified the player for 2 quarters in the pension plan that - in 2021 - would have been worth $11,500 per year for the rest of their life if taken at full retirement age.

Continuing to follow the course of the player's career from 2010 to 2014, you can start to see the importance of each day of service time in earning "pension quarters" throughout their career. While this player never reached free agency and did not reach the "full pension status" that everyone talks about, they did accrue 15 quarters into the pension system. This would have earned him a pension equivalent to $86,250 upon reaching full retirement age based on the 2021 IRS maximum annual benefit.

MLB Players Investment Plan/401k Plan

The investment plan (also known as the "Vanguard account" or "MLB 401k plan") is available to all active roster players. A little-known fact about this plan is that most financial advisors are prohibited by their employer from providing advice on a player's MLB 401k plan. Therefore, players often have a massive hole in their financial plan.

Advisors who are brokers and generally work for large brokerage firms are prohibited by their employers from doing the following:

Accessing a player's MLB 401k account

Advising on the contributions the player should make to the account

Advising on the investments within the account

Giving Advice on whether a player should rollover, keep, or convert the account once retired

These brokerage firms are often referred to as Wirehouses. Examples of brokerage firms include Merrill Lynch, Morgan Stanley, UBS, Edward Jones, SunTrust, Wells Fargo, RBS, and many other banks.

MLB 401k Plan Basics

In the collective bargaining agreement, MLB 401k contributions are referred to as "Article XXIII Contributions," and the amounts are subject to change from year to year. Contributions in the MLB 401k are a combination of pre-tax and post-tax deferrals by the player and the Article XXIII Contributions by Major League Baseball and its teams.

In 2022 the IRS will allow an MLB player to make a maximum pre-tax contribution into their 401k plan of $20,500, with a total contribution limit inclusive of company matches of $61,000.

How do I earn an Article XXIII Contribution?

Article XXIII Contributions are made to the 401k plan account of any player who earns at least one quarter (43 days) of MLB Service time during the season. These contributions are made for each player, whether they have ever made any pre-tax or post-tax contributions to the 401k plan on their own.

While the pension plan keeps a continuous count of days of service time earned throughout a player's career, the 401k contributions only look at each individual year to see if a player qualified for a contribution during that season.

For the team to contribute the maximum to a player's 401k, a player needs to earn four full quarters of service time in a season. There is no credit for partial quarters earned.

The example below shows the effects of not having the days roll over from year to year in the 401k plan:

In the table above, the impact of not having days rollover in the 401k plan can be seen by the fewer total number of Article XXIII Contributions made during the player's career. For example, while this player would have earned 15 quarters in the pension plan because of the continuous accruing of days throughout their career, they only earned 14 contributions under the 401k plan.

How much is an Article XXIII Contribution?

The amount contributed per quarter is not a set amount and can change each year.

In 2017, teams contributed $12,000 per quarter (total of $48,000) for a player who earned all four quarters during the 2017 season. In comparison, during 2021, the maximum amount that was contributed to a player's account as an Article XXIII Contribution was only $4,600 per quarter, which meant that the total team contributions only amounted to $18,400. This was almost $40,000 less than what had been contributed in other years.

Do Not Get Trapped By The "Uns"

Not only should your financial team be aware of and understand the 401k Plan, but they should also be willing and able to manage these investments for you. Unfortunately, many financial advisors are often unaware, unable, and/or unwilling to do this for their clients.

Unable

The fact that an advisor is unable to access or provide advice on a player's MLB 401k or cash received from their pension is not entirely the financial advisor's fault, but it should raise concerns. Often, the player is unaware that their financial advisor is prohibited by their employer from managing their entire financial world.

Think about the nature of an advisor's business. Suppose they are unable to access the account. In that case, the advisor has no incentive to understand or become aware of a player's 401k or pension plan and how they work. This is a major red flag and leaves a massive hole in your and your family's financial plan.

This should be a reality check for the player. They should ask their financial advisor why they are unable to provide advice on all their finances. The player should also ask the follow-up question that - if this is a trusted relationship - why is the player only finding out about this now and not before they started working together.

Unaware

Countless times we have heard stories or had conversations with players whose financial advisors were unaware or knew very little about their 401k plan. What's sad about this is that these players often get advice from unqualified sources such as their teammates if they get any advice at all instead of relying on the expertise or ability of their financial advisor.

Unwilling

This section is harsh but true. An advisor who is unaware and unable to provide advice on all money for a player has shown that they are unwilling to be a trusted advisor within a player's life. With the decision to work for a firm that cannot provide or chooses not to provide advice on everything that matters to the player, the advisor is sending the message that they will put their company's needs before the needs of the player and their family. To us, this is not only unacceptable, but it is simply wrong.

When hiring a financial advisor, the most important thing is to know and understand your financial advisor's capabilities and incentives. These might seem like hard questions to ask, but the answers are telling.

When you ask these questions, you verify that the people you hire are experts in working with clients of your profile. For an MLB player, this means they understand the complexity of your financial life. Further, these questions will help give you confidence that no conflicts of interest exist that might hurt you. Finally, you want to be sure that a financial advisor can demonstrate their expertise and that they have a legal obligation to always act in your best interest. Unfortunately, these are not requirements by our financial industry.

Article by Will McGuffey, CFP® - Private Wealth Advisor at AWM Capital, Licensed Attorney