How The New Tax Reform Effects Your Signing Bonus

At the end of 2017 President Donald Trump approved “The Tax Cuts and Jobs Act of 2017 (TCJA)” which went into effect in 2018. There are new provisions that have a dramatic effect on your MLB Signing Bonus and now require more proactive planning than ever before.

THE GOOD NEWS IS…

FEDERAL TAX BRACKETS

New law: The top individual tax bracket was lowered from 39.6% to 37% for individuals with taxable income of $500,000.

Why this matters: The 2.6% decrease lowers your effective tax rate but not necessarily your liability as many professional athlete tax deductions commonly used will no longer be available.

THE BAD NEWS IS…

STATE AND PROPERTY TAXES

New law: The TCJA limits deductions on state and local income, sales and property taxes (SALT deductions) up to $10,000 per year. Previously, the deduction had been unlimited (subject to alternative minimum tax and the Pease limitations).

Why this matters: As an athlete you pay taxes in multiple states. Historically, you received a deduction on your Federal Tax Return for making these payments. With the new law the majority of the benefit has been eliminated.

ITEMIZED DEDUCTIONS (a.k.a. write-offs)

New law: All individual tax deductions except for those that incentivized home ownership, charitable contributions and retirement contributions are no longer available.

Why this matters:This is the major negative hit to you as an athlete. You will no longer be able to deduct (write-off) agent fees, training expenses, union dues, clubhouse tips, travel expenses, etc. This may increase the amount of tax you pay.

SO WHAT TAX PLANNING SHOULD YOU DO?

As a player, your ultimate goal is not the gross MLB signing bonus amount; rather, it is the net (after-tax) amount. How your signing bonus is structured will have the greatest impact on how much money you actually receive.

Where Your MLB Signing Bonus Will Be Taxed

The first critical piece of information you must understand is how your signing bonus will be taxed.

What Does the Contract Say

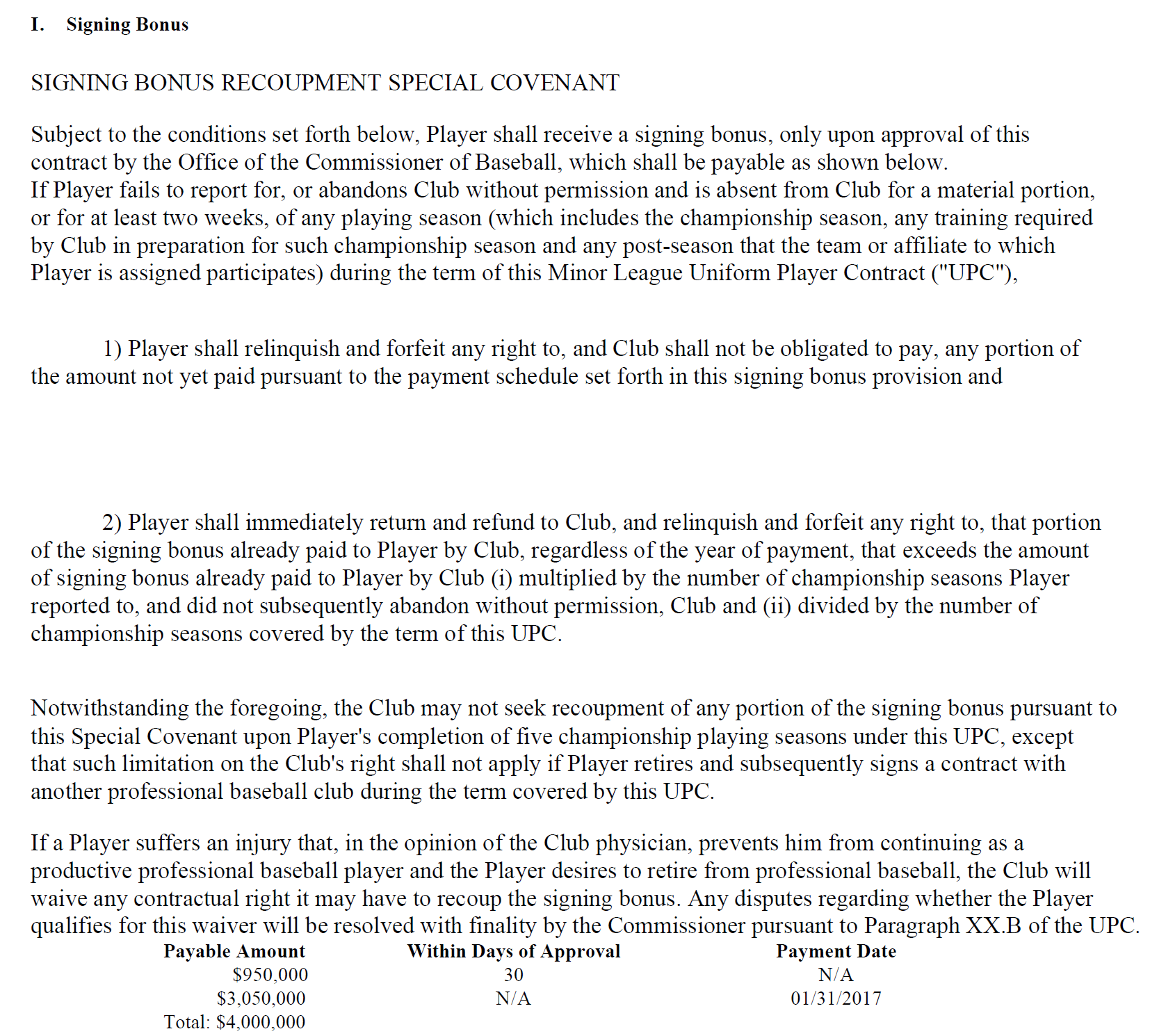

Unfortunately, the Standard Minor League Uniform Contract contains a “Recoupment Special Covenant Clause” which makes income apportioned as part of regular wages. In simple terms, your signing bonus is taxed in the state(s) in which you play.

Recoupment Special Covenant Clause States:

“If player fails to report for, or abandons Club without permission and is absent from Club for a material portion, or for at least two weeks, of any playing season (which includes the championship season, any training required by Club in preparation for such championship season and any post-season that the team or affiliate to which Player is assigned participates) during the term of this Minor League Uniform Player Contract (“UPC”),

Player shall relinquish and forfeit any right to, and Club shall not be obligated to pay, any portion of the amount not yet paid pursuant to the payment schedule set forth in this signing provision and;

Player shall immediately return and refund to the Club, and relinquish and forfeit any right to, that portion of the signing bonus already paid to Player by Club, regardless of the year of payment, that exceeds the amount of signing bonus already paid to Player by Club (i) multiplied by the number of champion-ship seasons Player reported to, and did not subsequently abandon without permission, Club and (ii) divided by the number of championship seasons covered by the team of this UPC.”

The addition of this language to the contract violates the following two conditions of a true “signing” bonus, resulting in the income being apportioned as part of regular wages:

the bonus is not conditional on playing any games for the team;

and is not refundable.

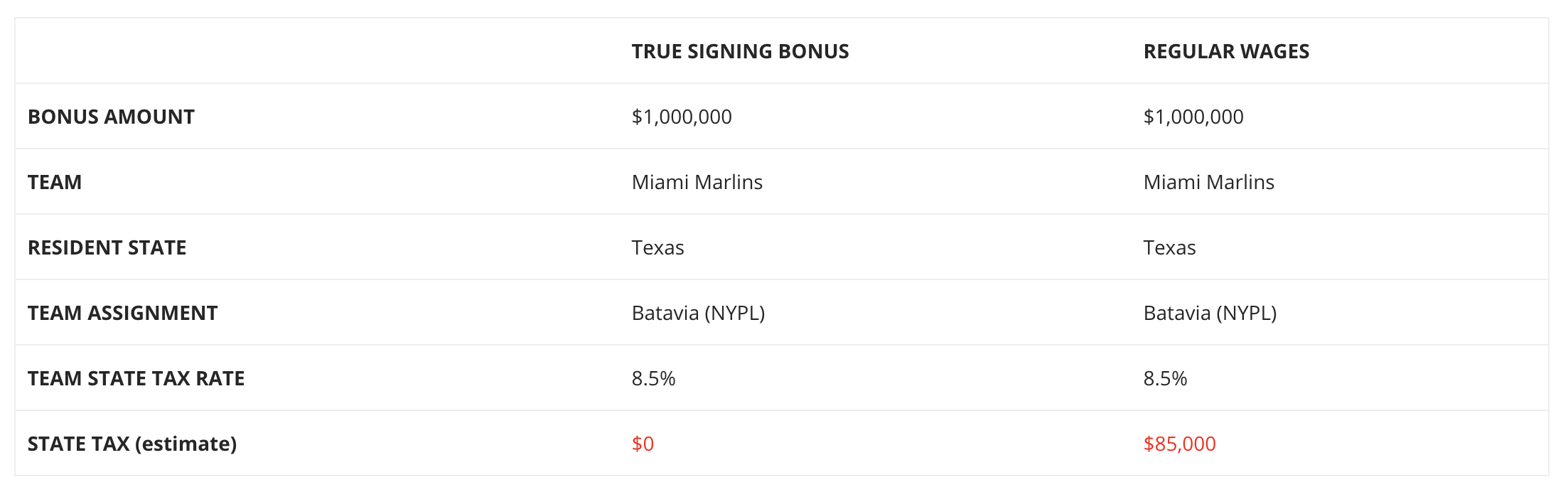

As a simple illustration, take the following 2 scenarios:

TRUE SIGNING BONUSREGULAR WAGESBONUS AMOUNT$1,000,000$1,000,000TEAMMiami MarlinsMiami MarlinsRESIDENT STATETexasTexasTEAM ASSIGNMENTBatavia (NYPL)Batavia (NYPL)TEAM STATE TAX RATE8.5%8.5%STATE TAX (estimate)$0$85,000

As you can see, the impact of whether a player’s MLB signing bonus is considered a true “signing” bonus versus regular wages carries significant tax consequences.

Can This Be Negotiated?

The short answer is yes, however, to be clear it is extremely rare that a team will be willing to make this concession for good reason. Teams have been burned in the past by players who walked away from the game shortly after signing and the teams were left with no recourse. In the past decade, in which we have been working with agents and teams we can count on one hand how many times we have seen this happen.

Residency

Where you live can have a dramatic effect on your overall tax situation. Income tax rates vary by state, with a handful of states currently having no income tax. With the new TCJA limiting the deduction for state and local income, property and sales taxes to $10,000, where you are a resident is magnified.

State Residency is one of the hottest topics surrounding professional athletes. It is also one of the most misunderstood. The days of simply using someone else’s address and getting a new driver’s license as a way to “claim” residency are over. States have become more savvy and are proactive in securing what they believe is their rightful claim of an athlete’s income. We will detail the steps a player needs to take and the require documentation in our upcoming article, “Establishing Residency.”

Payment Structure

Historically, teams have split the gross amount into two equal payments over two years.

It is a common misperception that the 50/50 payment structure is the only option. Each player’s situation is unique and therefore needs to be evaluated on a case by case basis. The major factors that will determine the structure will be on team assignment and residency. Accelerating or deferring the bonus into uneven payments can generally reduce the overall liability by taking advantage of the graduated tax rates and team assignment depending on the circumstances.

We will be covering these details in an upcoming article, “How To Negotiate Your After-Tax MLB Signing Bonus.”

Many families ask, “doesn’t my agent do this?”

The best agents recognize the importance of tax planning and will request the support of a Certified Public Accountant (CPA) who specializes in working with professional athletes. However, agents are equally cautious to keep themselves separate from a player’s financial decisions to avoid any potential conflicts of interest. This puts the responsibility on the player and his family to ensure the tax planning is happening.

Signs That You May Need a Second Opinion

Your agent is telling you not to worry about a financial advisor until after the draft

Your agent tells you a team will never negotiate the structure of your bonus

Your agent tells you a 60/40 split is how you should structure it

I would highly encourage you to ask for an example of a contract from a player the agent represented or the financial advisor works with in last year’s draft similar to the one below. This will give you the confidence that your team has the expertise necessary.

What Should You Do?

Schedule a meeting before the draft with a a CPA (Certified Public Accountant) and CFP (Certified Financial Planner) who have experience helping players structure their MLB signing bonuses in the most tax efficient way. If you would like to schedule a call with our team you can do so here.