2017 MLB Vanguard 401(K)

WHAT IS THE VANGUARD 401(K) INVESTMENT PLAN?

The Investment Plan, also known as a 401(k), allows you to:

Accumulate a significant amount of cash you can use to help provide financial security during retirement.

Get an immediate tax break, because contributions come out of your paycheck before taxes are withheld.

Get tax-deferred growth — meaning you don’t pay taxes each year on capital gains, dividends, and other distributions. This allows your money to compound more quickly than it would if it were taxed yearly.

HOW DO I CONTRIBUTE?

MLB has set up your plan so that maximum amount will be AUTOMATICALLY taken out of your paycheck unless you elect to have a lesser amount taken out or opt out completely. For 2017, the maximum amounts of pre-tax and post-tax deferrals for each player are $18,000 and $36,000, respectively.

However, in 2017 if a player receives a full year of service, they are limited to a maximum “Pre-Tax” contribution of $6,000 due to the team contribution of $48,000 which we discuss below.

SHOULD I CONTRIBUTE THE FULL AMOUNT?

“No” is the short-answer. There are two different types of contributions, and for most players, one is more advantageous than the other.

THE TWO TYPES OF CONTRIBUTIONS

Pre-tax Contributions: Pre-tax contributions are deposited into your account before any federal and state taxes are withheld. This means that your income taxes are deferred to a later date – you pay no income taxes on your contributions or their investment earnings while they remain in the Investment Plan.

Post-tax Contributions: These “after-tax” contributions are made to your account from income that Uncle Sam has already taken his share of. This effectively is a forced savings program. The pitfalls of the post-tax account are the money now has limited liquidity and the investment options are limited to the plan options. With a great financial team in place, you will have more investment options available to you without sacrificing access to your money.

WHEN SHOULD I NOT CONTRIBUTE?

You should only contribute to your 401k plan if you have a fully funded savings account. A general rule of thumb for a professional athlete is to have a minimum of 1 year of living expenses set aside in a savings account. One of the initial building blocks of a strong financial foundation is liquidity, meaning you can access your money immediately without being charged a fee. For all its tax advantages, the 401(k) is not a penalty-free ride. If you are forced to pull out money from your account before age 59-1/2, with few exceptions, you’ll owe income taxes on the amount withdrawn, plus an additional 10% penalty.

If you do not meet this first requirement, it is most likely in your best interest to not contribute to the investment plan and to build up your emergency savings first. Remember, you are automatically enrolled in the plan, so it is critical that you submit a Request for Change Form to elect out of the plan.

DO TEAMS MATCH MY CONTRIBUTIONS?

Another item of confusion is whether teams “match” your contributions. Teams do not match your contributions. They do, however, make discretionary contributions for each eligible player. Contribution will be made to the Investment Plan accounts of Players who are active for at least one quarter of the 2017 Championship Season.

HOW IS A PLAYER’S CONTRIBUTION CALCULATED?

For every quarter of Credited Service a player earns in 2017, a contribution of $12,000 will be made to his Investment Plan account. A Player who is on the Active List for the entire 2017 Championship Season, for example, will be credited with 4 quarters of Credited Service and will thus receive an allocation of $48,000 (4 quarters x $12,000 per quarter). Partial quarters of Credited Service are not counted.

A club contributions account will be maintained for each eligible player, regardless of whether that player has contributed to the Investment Plan.

WHAT IMPACT WILL THE ARTICLE XXIII CONTRIBUTION HAVE ON A PLAYER’S CONTRIBUTIONS TO HIS INVESTMENT PLAN ACCOUNT?

Because the tax laws limit the total amount of contributions to a Player’s Investment Plan account in one year ($54,000 in 2017), an Article XXIII Contribution could affect the amount of Pre-Tax and Post-Tax Contributions that may be made to his account in 2017.

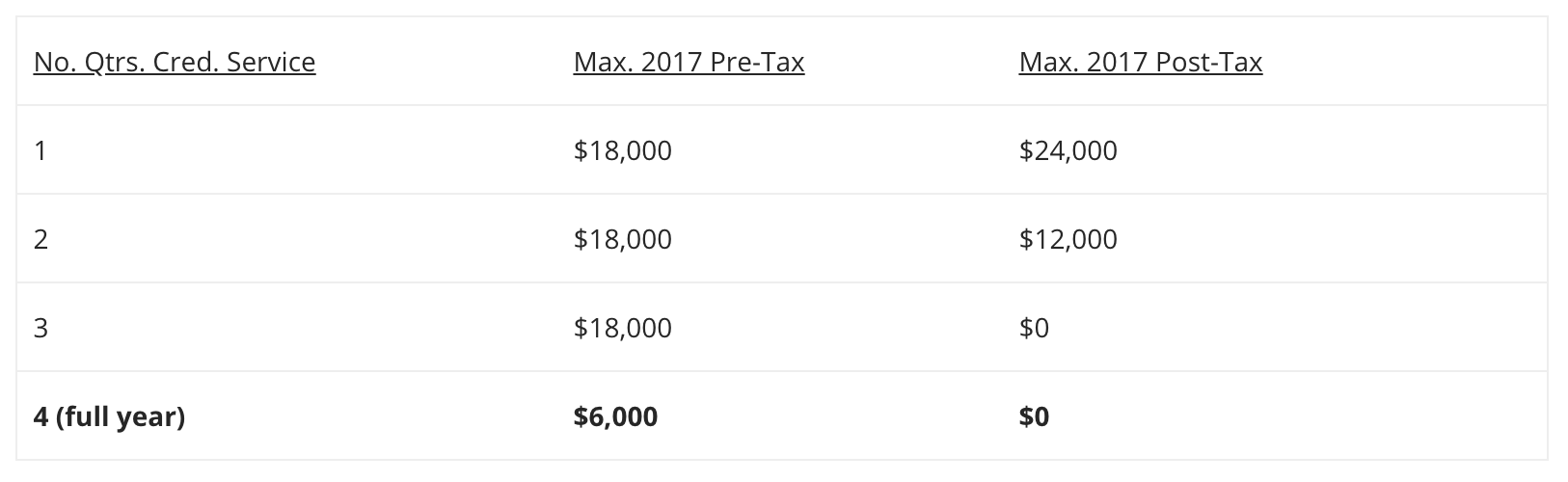

A Player who otherwise would elect to make the maximum Pre-Tax ($18,000) and Post-Tax ($36,000) Contribution to his Investment Plan account in 2017 should make a smaller Pre-Tax Contribution and no Post-Tax Contribution in 2017, to reflect the anticipated Article XXIII Contribution that he expects to receive. A Player who wishes to contribute the maximum amount to his Investment Plan account in 2017 should authorize the following Pre-Tax and Post-Tax Contributions, depending on the amount of Credited Service he expects in 2017:

A player who expects to earn a full year of service should contribute $6,000 pre-tax and $0 post-tax if he wants to maximize his contribution. Until the 2017 Championship Season is completed, it is not possible to determine how many quarters of Credited Service will be earned by each Player. Consequently, the maximum 2017 Pre-Tax Contribution and Post-Tax Contribution with respect to each Player only can be estimated at this time. Remember that if a Player is released or sent down to the Minor Leagues during the Championship Season, and anticipates receiving less than four quarters of Article XXIII contribution, he can increase his salary deferral election from his last paycheck in order to maximize his annual contribution in the event he is not reinstated.

YOU ARE RESPONSIBLE FOR MANAGING THE INVESTMENTS

The last area of confusion is who is responsible for managing the actual investments within the account. The answer is, YOU!

If you choose not to do anything, your account contributions will be automatically invested in the Vanguard LifeStrategy Conservative Growth Fund.

We do not believe “one size fits all” and is critical to ensure your investments are allocated correctly, taking into account the appropriate amount of risk and potential return. Your financial advisor should be guiding you through this process.

OK, WHAT SHOULD I DO?

This depends on your personal financial situation. However, in general, complete an Enrollment and Request Change Form as follows:

Check the Pre-tax annual contribution: Write in appropriate amount dependent on projected service time in 2017. A player who expects to earn a full year of service should contribute $6,000 pre-tax

Check the After-tax annual contribution: Zero dollars contributed

Check the Catch-up pre-tax contribution: Zero dollars contributed

Set up your account at vanguard.com/register and follow the prompts. You will need your plan number: 091338

STILL HAVE QUESTIONS?

Again, as an MLB player you have access to great retirement options. We strongly encourage you to contact us with any questions you have. We have been working with professional athletes for 30 years and we excel at navigating the unique financial situations that professional athletes face.